Churches are closing. What should they do with their assets?

Invested Faith offers one possibility: give them to social entrepreneurs doing transformative work.

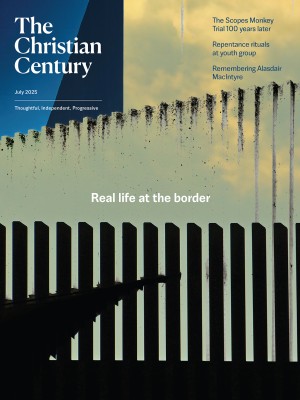

Invested Faith fellows (clockwise from upper left) Kit Evans-Ford, Robert Rueda, Aileen Maquiraya, Angela Moy, and Chelsea Spyres (Courtesy of Invested Faith)

There is a powerful paradox in American church life these days: individual churches are going broke, while collectively they control trillions of dollars.

The last comprehensive study of church closings, published in 2019, revealed that American churches were closing at the rate of 4,500 per year—almost 90 each week. Although more recent empirical data is not available, one gets the sense that this trend is only accelerating. A Hemingway character, asked how he went broke, replies, “Two ways. Gradually and then suddenly.” Lately it can seem as if we have moved from the gradual part to the sudden part of what has been called “the great de-churching” of America. Churches are closing at an accelerating pace due to membership decline and its attendant financial woes.

At the same time, religious institutions in America have more in assets than Apple, Microsoft, and Google combined. Many of those assets are in the form of church buildings, which are both the source of considerable wealth and often the cause of financial strain as well. Churches also control other resources. Endowments are the most obvious, and often the largest, source of many congregations’ wealth. Then there are the miscellaneous funds: special funds established for organ maintenance or cemetery care, funds held by the women’s fellowship or the missionary union, funds designated for the support of ministries that are no longer active. The list could be extended almost endlessly. Some funds may be so small that they are easily overlooked. Considered together, however, they make up a story of great wealth and great potential.

Read our latest issue or browse back issues.

Invested Faith is attempting to take advantage of this paradox. The organization, founded in 2020, connects individuals and churches who have resources—in particular, churches that are closing—with social entrepreneurs who are doing transformative work. They use contributions to offer grants to faith-rooted innovators whose fledgling enterprises work for systemic change in creative ways. Invested Faith named its first fellows (the title it gives its grantees) in 2021. There are now more than 70 fellows in 24 states and the District of Columbia.

Invested Faith fellows are engaged in a striking variety of work. Jillian Shannon runs Neotopia, a self-described “postmodern bookstore” in San Antonio, Texas, that carries only progressive theological literature. Robert Rueda founded and operates Global Blends, a “pay what you can” coffee shop and deli in Edinburg, Texas. Chris Lawrence founded El Barrio Homes, an organization in East Harlem, New York, that seeks to create affordable housing for religious and social service workers in the neighborhoods where they work.

Kit Evans-Ford founded Argrow’s House in Davenport, Iowa, a home for women who are survivors of domestic abuse or sexual violence. Residents are given the opportunity to join a social enterprise associated with Argrow’s House, producing a line of bath and beauty products in a safe and affirming environment while earning a living wage.

Chelsea Spyres runs the Wilmington Kitchen Collective in Wilmington, Delaware. The collective utilizes church kitchens, which often sit empty most of the week, to offer culinary entrepreneurs an affordable option for high-quality commercial kitchen facilities. Spyres reflects on this new endeavor’s points of continuity with the past: “I think of how church kitchens were the hub of community meals and of outreach for that church. And we are trying to reclaim that. It can be true again, even if not in the same way. People might not be coming through the doors in the same way, but we can invite in business owners who take the food out. There is still a lot of space for community.”

Some Invested Faith fellows, such as Evans-Ford and Spyres, are ordained ministers. Most are not.

Angela Moy and Aileen Maquiraya are the founders of LKE DOJO, a training program in Muay Thai, a martial art that originated in Thailand. Their dojo is unique because it caters to women and queer people, two communities that have often been excluded from participation in martial arts. Moy explains why members of these communities often respond to the ferocity of Muay Thai. “I’m finding my voice,” she says, “using my body, discovering the power that has been suppressed for so long.” Moy grants this irony: “The more violence you know you are capable of, the calmer you are. When you are powerful you can just rest in that and be more peaceful.”

Although Moy and Maquiraya do not adhere to any particular religious tradition, their sessions begin with meditation and they see faith as central to their work. According to Moy, this can be “faith within ourselves, faith in others, in the universe, or divinity, or God.” Despite that grounding, Moy is astonished that an organization with the word faith in its name would give them a grant.

The grants are not large—$5,000 each—but they can have an outsized impact on those leading a start-up through the early stages of development. What may be just as valuable is the recognition that comes with receiving a grant. Moy puts it this way: “We felt we were alone, hacking through a forest getting to somewhere we hope is there, what we can see in our minds but have no evidence of in the real world. So it is validating to have someone look at our work and say, ‘I see the value in what you are doing.’”

Originally, the grants were seen as a way to support individual fellows in their work. Increasingly, however, those associated with Invested Faith see connecting the fellows to one another as central to their work. Becoming a fellow provides an opportunity for mutual support and a sense of shared endeavor in work that otherwise can be isolating. According to Evans-Ford, it is “an opportunity to connect with each other’s souls and to encourage each other.”

Invested Faith was founded by Amy Butler, an American Baptist pastor who has served as senior minister of some of the most prominent and well-resourced congregations in the country: Calvary Baptist Church and National City Christian Church, both in Washington, DC, and the Riverside Church in New York.

The concept for Invested Faith germinated in the months after Butler’s painful parting of ways with Riverside Church in 2019. Butler went to the United Kingdom for two months, in part to learn more about an organization there called Seedbeds. Started with a £9 million gift—about $12 million—Seedbeds gives grants to businesses that are addressing injustices in creative ways. At the time of Butler’s visit, Seedbeds was already two decades old and had given grants to businesses throughout the UK, but it still didn’t have an online presence or a formal grant application process. Their process was simple: when they saw a business in need of funds for their work forwarding the cause of justice, they gave a grant.

Butler contends that “every single social enterprise that is impacting the UK can be traced back to Seedbeds.” Whether or not that assessment is strictly accurate, it is clear that the Seedbeds influence has been enormous in scope. It helped Butler see the potential for supporting social entrepreneurs in the United States.

Upon her return, Butler spent two years building the infrastructure for Invested Faith—assembling a board, launching a website, and gathering supporters. The concept was simple: Invested Faith would receive donations, largely from dying churches, providing what Butler calls “a hopeful way to invest in their future” by supporting social entrepreneurs who are working for systemic change.

Butler says that her work with congregations in the process of closing begins with some frank talk: “We can cover our eyes and hide under a pillow and ask if what we have created can sustain itself for the next 500 years—but that’s not really happening. I’m just saying: You’re dying. That’s sad. We’re people of faith who believe new life comes out of death.”

She elaborates, drawing on her experience as a pastor. “What we need to move through our grief,” she says, “is the reassurance, the evidence, that God is still at work. The church needs us to step up and to say there’s a future, and it’s hopeful, and we can go there together.”

In particular, Butler sees a hopeful future in the work of faith-rooted social entrepreneurs who are doing transformational work without much institutional support. Many operate more like businesses than like religious organizations, but with this difference: they are doing some of the work associated with church—building community, feeding the hungry, protecting the vulnerable, confronting social injustice. Butler is encouraged by the variety of ways social entrepreneurs are addressing these needs. “It is going to take the efforts of all kinds of innovators to create spaces where people are finding life, hope, faith, a sense of community,” she says.

Not all donations to Invested Faith come from dying churches. St. Peter’s United Church of Christ in Ferguson, Missouri, has seen steep membership decline in recent years: from 250 in worship 20 years ago to more like 50 today. Nevertheless, a loyal core of parishioners and a large endowment ensure that St. Peter’s will not be closing its doors in the foreseeable future. Early last year, St. Peter’s gave $200,000 to Invested Faith. In September, it pledged an additional $800,000.

Patrick Chandler, the pastor of St. Peter’s, admits that discussion of the gift initially created some anxiety in the congregation: “‘Does this mean we’re going to close?’ ‘What happens if we do close?’ But what we do with our assets is not a question we should be asking when we are down to three people in worship.” Over time, the congregation embraced the ministry of Invested Faith, in part because it increased the reach of their outreach. According to Chandler, through Invested Faith, “St. Peter’s continues to plant seeds of the gospel, seeds of justice, all over the country.”

As post-institutional as the work of Invested Faith may seem, Butler says that she is motivated by a love for the institutional church. “I will confess to you something that not a lot of people get about me,” she says. “I don’t do this for the fellows. The fellows are going to find their way. For me, it’s for the church—to create a compelling theological narrative for a future we can buy into. It’s for congregations and for people who have lost hope. The God we follow is not a God who leaves us with an absence of hope.”

Not everyone immediately embraced the concept of Invested Faith. In particular, denominations and other religious institutions were almost uniformly unsupportive. Butler recalls the frustration of those early attempts to gain the support of institutional leaders: “It’s like they think I am cannibalizing churches that are dying and taking advantage of them, rather than encouraging them to get a coffee bar and a praise band.”

One denominational executive—Jeffrey Haggray, the executive director of the Home Mission Society of the American Baptist Churches USA—supports Invested Faith, but he also understands why not everyone is on board with this approach to using church funds. “It is very hard to convince people to create a fund that will go directly to the support of individuals,” he says. Institutions are more comfortable giving to other institutions. According to Haggray, this can lead to an ironic situation: “Sometimes when entities dissolve, they give their money to another entity that is dissolving” rather than to an individual who is doing vital work.

Haggray contends that Invested Faith’s approach harkens back to an earlier time. “It’s very much like in the 1800s,” he says, “when we were funding missionaries who were going across America starting new entities. Some of them started seminaries, some started clinics, others started schools. They were all dealing with entrepreneurial ideas. The church had a vehicle for supporting these individuals who felt called to make a difference in the world, [a vehicle] that we don’t have today. We have grown skeptical of funding impassioned individuals who will have an impact on the world. But that is what Invested Faith is doing.”

One persistent question that Butler and others associated with Invested Faith have faced is whether the work of the social entrepreneurs can be described as church. Everyone I spoke with responded to that question by advocating a more expansive understanding of church. Chandler’s reflections were echoed by others: “It is church, as long as you aren’t defining church as a building that sits at the corner. As long as you have a more expansive notion of what church is. It’s going to look quite different. It’s going to be more grassroots, more justice-centered, because people are tired of this old institutional model we’ve been trying to prop up.”

Butler is adamant on this same point. “Church, in my ecclesiological understanding, is a community of people gathered around a message that motivates their shared and individual living. A community that can change the world—which is what the church should be—is found in these projects.”

Practical theologian Kenda Creasy Dean, drawing on a conversation with her colleague Ryan Bonfiglio, made a related point in a recent presentation to a group of pastors. “We don’t know what the church of the future is going to look like,” she said. “People will say, ‘Yeah, it’s all good what you are doing, but is it the church?’ Well, when Jesus was resurrected Christ, they did not recognize him. So, what makes us think we are going to recognize the resurrected church at first?”

That may be starting to change. Lately Spyres—the fellow who founded Wilmington Kitchen Collective—has noticed a difference in how the projects supported by Invested Faith are described. “We’re getting to a space,” she says, “where the institution is arguing less and less over whether it is church.”

Poet Wallace Stevens famously observed that we don’t so much live in a place as we live in a description of a place. In recent years, the description of the place in which the church has lived has been the narrative of decline. And, to be sure, there is much raw material that can be gathered in support of that narrative. It was never a faithful narrative, however, and increasingly it has become a boring one. In its own way, Invested Faith is trying to provide a new narrative—or rather, to help us reclaim a very old one—that is centered on resurrection instead of only on death.

Mitch Randall—the CEO of Good Faith Media, which has worked with Invested Faith—frames the group’s work in unapologetically theological terms. “Invested Faith is about making tangible the central affirmation of the Christian faith: we are resurrection people at our core,” he says. “Our church may be dying. Nevertheless, by furthering the work of the church through justice-seeking social innovators, this is an opportunity to be born again.”