The deficit doesn't matter

Thinking morally about the economy with Stephanie Kelton

Just before Christmas, Donald Trump signed the Republican tax bill which many predict will exacerbate wealth inequality in the country. Analyses project it will add over $1 trillion dollars to the deficit.

For all the talk about the national deficit and why it’s the reason our government can’t afford to improve healthcare or education, these developments reveal profound layers of hypocrisy. They show how deficit-talk has constrained political imagination and reduced the economy to a soulless, amoral balance sheet. Earlier this month, I sat down with one of our nation’s leading economists who’s been sounding the alarm on this precise problem.

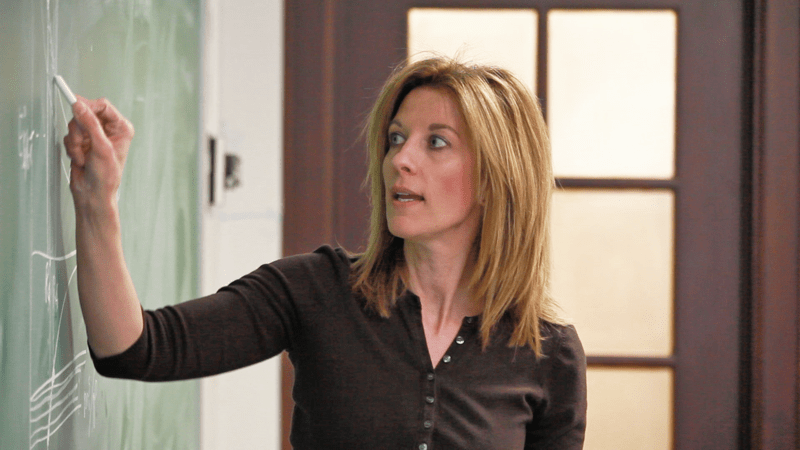

Stephanie Kelton is a professor at Stony Brook University and a former chief economist for the Senate Budget Committee Democratic staff. If there is such a thing as a prophetic economist, she might just be it. Kelton is not afraid to rattle the status quo. A former adviser to Bernie Sanders (she recalled her trip to the Vatican with him), she is now also providing economic advising to Rev. Barber’s new Poor People’s Campaign.