Murky mandate

Part of local lore at the Christian Century is a tale about the time our predecessors, unable to contain their dread of seeing Barry Goldwater in the White House, published an editorial endorsing Lyndon B. Johnson for president. This bit of electioneering was brought to the attention of the Internal Revenue Service, which proceeded to suspend the magazine’s tax-exempt status for two years. The editorial clearly violated the IRS rule that prohibits charitable organizations (referred to as Section 501(c)(3) organizations in the tax code) from backing a political candidate.

The rules are much less clear when it comes to “social welfare” organizations (known to the IRS as Section 501(c)(4) organizations). Unlike charitable organizations, these groups are allowed to engage in politics while maintaining their tax-exempt status, as long as politics is not their primary activity.

Read our latest issue or browse back issues.

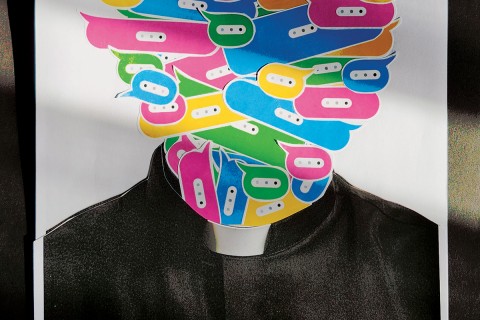

But how much political activity is too much? And how is political activity to be defined? Is it right that a group can spend millions of dollars to influence an election and still be deemed a “social welfare” organization? Is it right that such groups, as part of their status as social welfare organizations, are permitted to shield the names of their donors?

These are the real questions that lie behind the furor over the IRS’s practice—at least for a short time, at one office—of giving special scrutiny to conservative Tea Party and “patriot” groups that applied for 501(c)(4) status.

The prospect of a politically motivated IRS is chilling. But there is no evidence that the IRS rejected any group’s application for political reasons. Nor is there any evidence that scrutiny was unwarranted. The law compels the IRS to investigate groups that apply for tax-exempt status. The underlying problem is not the politicization of the IRS (its employees are well insulated from presidential directives) but the vagueness of the tax code. And the solution to that problem is for Congress to give clearer guidelines.

When an IRS office in Cincinnati issued its misguided directive on Tea Party groups, it was being flooded with new applications for 501(c)(4) status. The increase was in part the result of changes in the law allowing corporations and unions to give unlimited sums in elections. By giving their money to tax-exempt social welfare groups rather than to political action groups, these funders had a way both to spend without hindrance and to hide what they were doing.

Civil society is made more vibrant by the presence of groups organized around a social cause—which is a good rationale for giving such groups tax-exempt status. But citizens should know who is funding the election of office holders—which is a good reason for either requiring 501(c)(4) groups to reveal who their donors are or for sharply limiting how much politicking these groups can do.