Paying the child tax credit forward

It’s a terrific policy for fighting child poverty. But my family doesn’t need the money.

Last week I received the second installment of the federal child tax credit in my bank account.

Since 1998, families under a certain income level have been eligible for CTC funds for each dependent child. The American Rescue Plan—the COVID economic stimulus enacted this March—both significantly expanded the credit for one year and directed the IRS to pay half of it to families in advance, in the form of monthly deposits.

This program has been touted by the White House as “a needed tax relief for all working families,” and I appreciate what it will do for so many families still struggling through the pandemic and the economic woes that have come with it. With this money, children will have better access to food, housing, health care, and clothes for school.

The expanded CTC, together with other provisions of the American Rescue Plan, stands to cut child poverty in half, lifting 5.5 million children out of chronic poverty. And more than 70 percent of these children are Black or Brown. Child poverty and racism in the US have been their own chronic pandemics since long before 2020. It took an acute crisis and a change of leadership to turn the country’s attention toward addressing them.

Maybe your children, like mine, are without material need, and you wonder: Why am I getting this credit? I was unaware of just how the CTC is calculated; this tool helped me learn. I understand now that there are plenty of families like mine that receive this tax credit but don’t need it.

If you receive the CTC, does your family need this financial cushion right now? If you can enrich your children’s lives with sleepaway camp, vacations, expensive outings, private school, and/or their own car, perhaps you do not need the CTC to make ends meet.

To be sure, every family’s circumstances are different, and only you can answer such questions for yours. Many middle-class families depend on the CTC to buffer their child’s well-being. It is surely a relief to the more than 5 million families in which moms have stepped away from paid work during the pandemic.

If, however, your family’s material needs are met, maybe the best way to celebrate the CTC expansion is to pay it forward. Maybe there is a local agency that needs support. Consider giving out of your abundance. Share your part of the American Rescue Plan with organizations committed to ending child poverty.

More than half the US population will experience poverty at some point before age 65. But poverty has the most enduring impact on children. Those children experience more adverse childhood experiences, which set them up for a lifetime of chronic health concerns, emotional challenges, and social deficits. The pandemic has amplified and compounded these adverse experiences, especially for Black and Brown children.

The Children’s Defense Fund, which has fought child poverty for decades, is working to make the CTC expansion permanent. The CDF also advocates for CTC eligibility to be expanded to the most marginalized children, including children of immigrants who lack Social Security status.

When my spouse and I donated our first CTC deposit to the CDF, we wondered about the tax implications. Would we owe the funds back to the IRS on Tax Day?

I am not a CPA, and I cannot give financial or tax-related advice, so please consult your tax preparer and find out what the CTC means for your family. My own family anticipates a tax refund next year, so the CTC payments amount to an advance on this refund. That makes it easy and appealing to give the money away now. For the coming months, we will keep paying it forward to organizations working to reduce child poverty, end racist systems, and heal children who suffer adverse experiences.

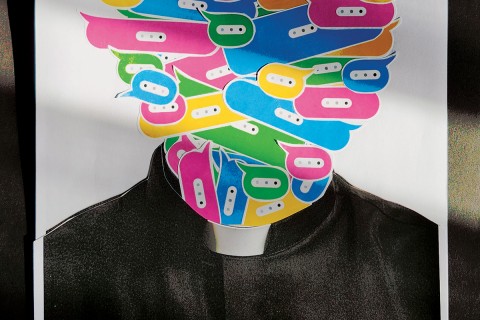

Many of us who embrace the sacredness of children based on our religious and ethical values have a unique opportunity. Along with celebrating the CTC’s expansion and calling for it be made permanent, we can direct money we didn’t anticipate and don’t need to causes that align with our hearts and values.