For some churches, paying back PPP loans is better than forgiveness

When Michigan’s governor required churches to stop meeting in person on March 16 last year, Kenton Sanders, director of operations at Mars Hill Bible Church, quickly did some worrying math.

About 40 percent of donations to the church in Grandville, Michigan, came during in-person services that drew some 1,750 people weekly. With in-person services shutting down, donations would surely tumble. If that happened, the church would have to lay off some of its staff.

“It was at the beginning of the pandemic, we had just gone online, and had no idea what was going to happen,” he said.

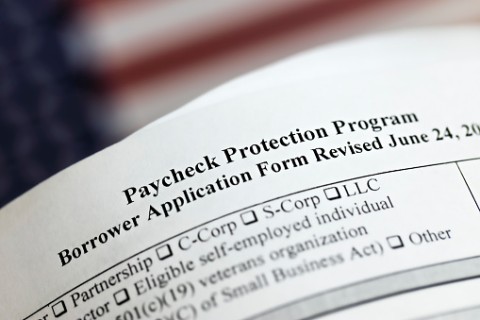

So, like more than 120,000 churches and other religious organizations nationwide, Mars Hill applied for help through the Paycheck Protection Program, the emergency loan program created by the CARES Act, a $2.2 trillion relief and stimulus package passed by Congress in March 2020.

Read our latest issue or browse back issues.

Under the PPP, the Small Business Administration funneled funds to local banks, which made loans to employers in their communities. Almost 12 million PPP loans were approved, for a total of $800 billion.

Mars Hill’s $295,000 loan, approved on April 14, 2020, was meant to protect two dozen jobs at the church, at least for a few months. But less than a month after the loan was approved, Sanders noticed that giving had actually gone up. In addition to regular offerings that came in online, church members were contributing to a benevolence fund, known as “the white bucket project,” to help neighbors in need during the pandemic.

After talking with other Mars Hill leaders, Sanders called the bank and returned the entire amount of the loan.

Mars Hill is one of a small number of religious organizations that took out large PPP loans only to pay them back in full—or to return the funds without ever withdrawing a penny.

According to a Religion News Service analysis of data from the SBA, 13,408 religious groups, mainly churches, were approved for loans of $150,000 or more. Of those, 100 paid the loans back without asking for the loans to be forgiven. Fewer than 50 other groups were approved for the loans but did not withdraw the funds.

The repaid loans range from $4.37 million to $150,500 and totaled just over $66 million. Those repaying the loans include 99 Christian groups and one Muslim organization.

More than 8,800 religious groups have asked for their loans to be forgiven—as the program was designed to allow. The status of another approximately 4,500 remaining loans has not yet been reported to the SBA by local banks.

To qualify for loan forgiveness, churches and other organizations had to certify that there was significant economic uncertainty when they applied for the loan.

There are some indications that congregations avoided major fiscal decline during the COVID-19 pandemic. More than half of the congregations in a fall 2020 study from Lake Institute on Faith and Giving at Indiana University-Purdue University Indianapolis said that giving had either stayed the same or gone up. Few (14 percent) said they had to lay off staff, while two-thirds applied for a PPP loan.

Alison Gill, vice president of American Atheists, said she appreciates religious groups that paid back their PPP loans rather than asking for forgiveness. “It shows an appreciation for the separation of church and state,” she said.

Still, American Atheists and other secular groups expressed concern over the program—especially if religious groups applied for forgiveness. That essentially turned loans into grants to pay the salaries of religious leaders, said Nick Little, vice president and general counsel of the Center for Inquiry, another atheist group.

Little said that having government funds paying the salaries of pastors, rabbis, priests, and other leaders was “constitutionally troubling.”

Uncertainty for many religious organizations, meanwhile, is far from over. At Mars Hill, Sanders said that the staff remains intact, and as the pandemic has eased, about 300 people now show up for weekend services. But others continue to attend only online. That makes long-term planning difficult.

“The hard part is that we don’t know how many people we have in our church anymore,” he said.

Still, he is thankful the PPP loan was repaid. “I am really proud to be part of a church that said, ‘No, we don’t need it—we are going to give it back.’” —Religion News Service