Churches use advocacy, small loans to fight predatory lending

Frederick Douglass Haynes III, a pastor in Dallas, saw two dozen payday loan and car-title loan stores open in a five-mile radius in his community.

Anyra Cano Valencia was having dinner with her husband, Carlos, and their family when an urgent knock came at their door.

The Valencias, pastors at Iglesia Bautista Victoria en Cristo in Fort Worth, Texas, opened the door to a overwhelmed congregant.

The woman and her family had borrowed $300 from a “money store” specializing in short-term, high-interest loans. Unable to repay quickly, they had rolled over the balance while the lender added fees and interest. The woman also took out a loan on the title to the family car and borrowed from other short-term lenders. By the time she came to the Valencias for help, the debt had ballooned to more than $10,000. The car was scheduled to be repossessed, and the woman and her family were in danger of losing their home.

The Valencias and their church were able to help the family save the car and recover, but the incident alerted them to a growing problem: lower-income Americans caught in a never-ending loan cycle.

An estimated 12 million Americans each year borrow money from stores offering payday loans, billed as a cash advance to tide workers over until their next paycheck.

The National Hispanic Christian Leadership Conference regularly brings the issue before state and national legislators, said Gus Reyes, chief operating officer, who noted that payday lending generates income for the lenders, but “takes advantage of those who are marginalized. Because we have a heart for those folks, that’s an important issue for us.”

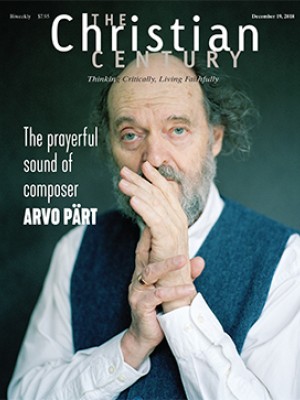

Read our latest issue or browse back issues.

Some churches are offering small-dollar loans to members and the community as an alternative. LaSalle Street Church in Chicago has dedicated $100,000 to a fund for small-dollar loans and hopes to expand it, said senior pastor Laura Truax.

The opposition to payday loans is not universal, however. Earlier this year a group of Florida pastors lobbied state lawmakers to allow one payday loan firm, Amscot, to expand operations.

Keith Stewart, pastor of the 2,000-member Springcreek Church in Garland, Texas, said one-third of the people coming to his congregation for assistance cited payday loans as a problem in their lives. The lenders “set up a credit trap and keep people in perpetual payments.”

Frederick Douglass Haynes III, who pastors the 12,000-member Friendship-West Baptist Church in Dallas, saw a local plant nursery and a nearby restaurant replaced by “money stores” offering payday loans. A bank branch turned into a car title loan store.

“In our community alone, a five-mile radius, you had 20 to 25 payday loan and/or car title loan stores,” Haynes said.

Then he saw the interest rates the lenders charged: “The highest I’ve seen is 900 percent; lowest is 300 percent” per year. State usury laws generally limit the amount of interest that can be charged, but loopholes and fees push the effective interest rate much higher.

Haynes and Stewart saw a need for local officials to place limits on the lenders. In Garland, Stewart and 50 members of his congregation testified at a city council hearing. Garland officials restricted what lenders could charge and how they could renew loans.

The payday lenders quickly left for other communities, Stewart said, but he and others succeeded in having those communities regulate the lenders as well.

In Dallas, those caught by payday loans asked, “What alternatives do we have?” Haynes recalled. “I was doing a great job of cursing the darkness, but there were no candles to light.”

He learned of the Nobel Prize–winning work of Muhammad Yunus, whose microloan concept helped millions in Bangladesh. Haynes became convinced the church needed a microloan fund to help those in need.

The church now operates Faith Cooperative Federal Credit Union, which offers checking and savings accounts as well as auto, mortgage, and personal loans. Among the loans are ones designed to replace those offered by payday lenders, with interest rates ranging from 15 percent to 19 percent, depending on a borrower’s credit standing.

“We’ve given out over $50,000 in small-dollar loans, and the rate of customers who pay back their loans in full is 95 percent,” Haynes said. “We’re demonstrating that people just need a chance without being exploited.”

Haynes said the credit union has helped members of his church beyond those needing a short-term loan.

“We’ve had persons caught in the debt trap set free because they have access to this alternative,” he said. “Then they open up accounts and get on the path toward not only financial freedom but also financial empowerment. The energy our church has invested in the credit union has been a blessing, and the credit union has been a blessing, because so many people have benefited.” —Religion News Service

A version of this article, which was edited December 11, appears in the print edition under the title “Churches use advocacy, small loans to fight predatory lending.”