Shaky economy imperils church pensions

Religious denominations have long provided retired clergy and staff

with secure pension payments--more secure, in some cases, than corporate

retirement plans. But some recent developments have drawn attention to

the vulnerabilities of so-called church plans, which are exempt from

federal regulations aimed at safeguarding retirement funds for

private-sector retirees.

As cash-strapped states and private

companies revamp, freeze or end their pension programs altogether,

participants in church plans are now realizing that such plans can be

riskier than they appear, observers say.

"As a group, employees in

so-called church plans are far more at risk than other private sector

employees," said Karen Ferguson, director of the Pension Rights Center, a

Washington-based watchdog group.

Unlike other private-sector

workers whose pensions are insured by the federal Pension Benefit

Guaranty Corporation, church employees have no federal agency poised to

rescue their employer-provided pensions in the event of a devastating

market crash. Yet "because there hasn't been a collapse of a [church]

pension board plan, everybody, I think, is comfortable leaving them

alone," Ferguson said. In several recent cases, however, churches have

failed to keep their plans fully funded to be able to meet obligations

to retirees:

Read our latest issue or browse back issues.

- In October, the Roman

Catholic Diocese of Wilmington (Delaware) said it had only $8.5 million

available to pay $52 million in pension liabilities. The diocese, which

is under Chapter 11 bankruptcy protection because of the clergy sexual

abuse scandal, is assuring pensioners that it will meet its obligations. -

In August, the Archdiocese of Boston informed employees that their

pension plan--funded at just 79 percent--is "unsustainable." The

archdiocese will keep paying its obligations, according to spokesman

Terrence Donilon, but a new market-based plan involving 401(k) or 403b

accounts will take effect January 1, 2012, funded through individual and

employer contributions. - About 12,000 Lutherans are seeing

their pension payments shrink by 6 to 9 percent annually from 2010

through 2012. The defined benefit program of the Evangelical Lutheran

Church in America was only 61 percent funded in February 2009 and has

been closed to new participants since January 1, 2010.

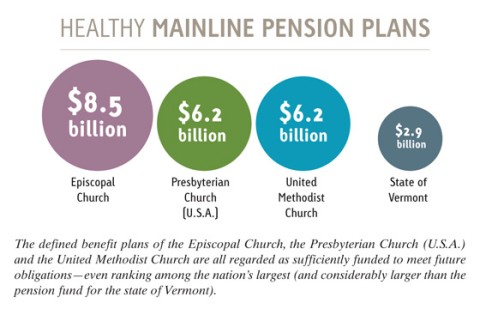

Other

major denominations are reporting no such problems with their benefit

plans. Several mainline denominations still offer defined benefit

programs--increasingly rare in the private sector--which promise to pay

retirees a fixed monthly sum based on a formula.

Defined benefit

plans of the Episcopal Church ($8.5 billion), the Presbyterian Church

(U.S.A.) ($6.2 billion) and the United Methodist Church ($6.2 billion)

are all sufficiently funded to meet future obligations, according to

church spokespeople. Those three denominational pension funds rank among

the nation's largest, each of them more than twice the size of

Vermont's $2.9 billion state pension fund, for example.

Unconvinced

that they should follow the lead of corporate America and offer more

plans like a 401(k), the organizations overseeing these assets remain

committed to offering defined benefits.

"We maintain a prudent,

long-term, disciplined and measured investment strategy, and remain

convinced that this approach is the most prudent for achieving positive

long-term investment results," said Colette Nies, spokeswoman for the

United Methodist Church's General Board of Pension and Health Benefits,

in an e-mail.

Observers cautioned church pensioners not to get lulled into a false sense of security.

"The

church world tended to be a place that wanted, in the case of clergy,

to protect those people from ordination to grave," said David Powell, a

Washington attorney and church pension expert who's written the only

book on the subject. "They wanted to make those sorts of pension

promises. It's the affordability of them that has got many of them

concerned now."

Powell said some denominations are considering

switching from defined benefits to less-expensive defined contribution

plans, such as those used by the ELCA and the American Baptist Churches

USA. In the meantime, however, their assurances of sufficient funding

don't necessarily mean much in Powell's view.

"A lot of this is

rather fuzzy accounting," Powell said. "You're really trying to guess:

how much money do I need now in order to pay Joe Blow $110 per month,

commencing in 2030? . . . Actuaries will give you different assumptions,

and it can vary very widely."

Pension concerns have been brewing

in some denominations since before stock markets crashed in 2008. The

ELCA, for instance, is battling a lawsuit from retirees of its

publishing arm, Augsburg Fortress. At a December 8 federal court hearing

in Minneapolis, lawyers sparred over whether the ELCA owes a debt to

Augsburg Fortress pensioners, whose plan was dissolved a year ago after

years of underfunding. A ruling on preliminary questions is expected in

early 2011.

Church plans could qualify for federal insurance if

they were to comply voluntarily with associated federal regulations,

according to Pension Rights Center spokeswoman Nancy Hwa. But few if

any have taken that step.

The PRC's Ferguson said pension funds

of major denominations are managed professionally, and she has no reason

to think they might be in trouble. But because church plans don't have

to disclose their funding levels to the public, a funding crisis could

potentially go undetected.

"Most people don't realize there's a

problem" until they discover that their pensions are in jeopardy,

Ferguson said. "They don't know their plans are not protected by the

law. . . . You assume everything is going to be all right, especially if

you're in a religious organization. You assume that the church is going

to look out for you."

Denominational pension boards send out

annual reports to the likes of Les Pettit, a disabled 67-year-old United

Methodist minister who retired in Berwick, Maine, two years ago after

25 years in parish ministry. To him, the annual report isn't very

illuminating.

"You'd have to be an accountant to understand it,"

Pettit said, adding that he has "great confidence" in those overseeing

his pension funds but admits he's taking their word for it. "It's fine

as far as I know now, but who knows?" Pettit said. "You put your trust

in [managers and administrators]. Then you hope and pray they're as

honest as they claim to be." -RNS