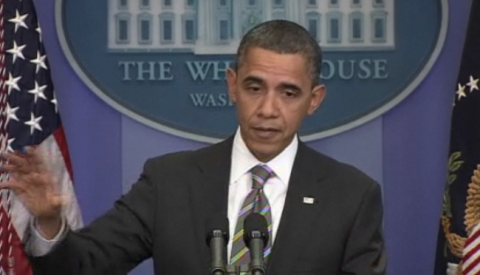

Obama's deal

The big political news this week is yesterday's deal

between the White House and Republican leaders: in exchange for extending the

Bush tax cuts for two years and relaxing the estate tax, Obama got a 13-month

extension of unemployment benefits, a one-year payroll tax decrease and some

additional tax credits and breaks.

Wait, tax breaks are what he got in the deal? I thought Democrats loved taxes! Actually,

center-to-left economic thought maintains that in tough economic times, what

you need to do is stimulate the economy--either with government spending or

with tax relief for lower- and middle-income people. (Tea Party slogans

notwithstanding, last year's stimulus bill did

both.) The resulting short-term deficits are okay; you deal with them once times

have improved.

As for unemployment benefits, Tim Fernholz nails

it: "one galling aspect...is that emergency unemployment insurance became a

policy option that had to be bargained for, rather than a given during tough

times," as it was for President Reagan and a Republican Senate in the early

1980s.

John Avlon thinks

Obama could have gotten a better deal if he were a tougher negotiator. Jonathan

Bernstein disagrees,

as

does Steve Benen: "I'm comfortable putting this in the 'better than

expected' category."

I'm on team better-than-expected on this one. I certainly

share Laura Conaway's frustration

with tax cuts for the rich, but her complaint about how much the deal adds to

the deficit is off base. For weeks, deficit cutting has purportedly been at the

top of the agenda, even though the economy has not yet recovered. As David

Leonhardt puts it,

the deal on tax cuts "looks an awful lot like a second stimulus"--which,

despite the White House's hair-splitting denial

of the politically poisonous word, is exactly what we need.

Still, the concessions Obama had to make here are downright

odious. Tax cuts for the rich drive up the deficit while doing virtually

nothing to stimulate the economy--whichever problem is more pressing, this

move doesn't help one and makes the other worse. You might defend these tax

cuts on the ideological grounds that all taxes should always be lower, details

and context be damned; if you're rich you might appreciate the extra money in your

pocket. But these aren't what I'd call morally inspiring positions.

Congressional liberals certainly don't think so, and they may

well refuse to support the deal. If they can get a better

one and pass it, good for them. But Obama deserves credit for a deal that

would stimulate the economy, maintain poverty-fighting tax credits and keep the

unemployed from becoming homeless--negotiated with an opposition party that barely

manages anymore even to feign interest in good-faith compromise, coherent

arguments or the common good. Tax cuts for the rich are the only bargaining

chip the Republicans value these days--and that's their shame, not Obama's.