What our taxes pay for

Frustration with taxes and government spending is high these

days. Specific opinions as to where

the government is overspending are fewer and farther between. Most taxpayers

don't know what they'd like to see cut, partly because they don't know how the

spending breaks down in the first place. (Elected officials are often hesitant

to get specific as well; that's a topic for another post.)

The policy proposals offered by Third Way—a leading

center-left think tank—often disappoint with their oh-so-careful incrementalism. But here I think they're right on: when

you pay your federal income taxes, you ought to get an itemized receipt. In a policy

brief (pdf) published last month, Third Way's David Kendall and Jim Kessler

make the case for such a service and explain how it could easily be

implemented.

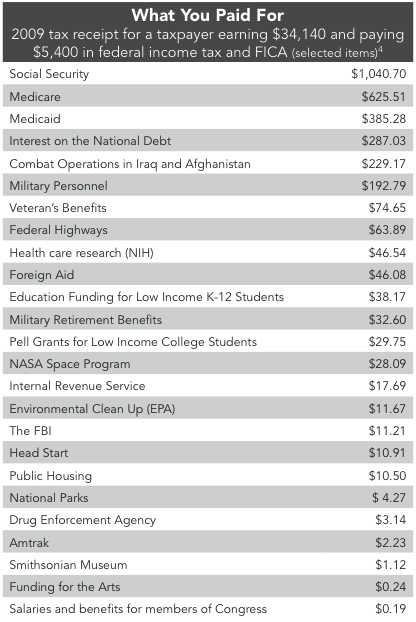

Here's a sample receipt for a middle-class earner:

I'm a fierce (and somewhat excitable) supporter of passenger

rail, and whenever I get going on this someone inevitably points out that

highways, unlike train tracks, are paid for with fuel taxes. Of course, the

government routinely makes up for highway-funding shortfalls using the general

revenue—to the tune of 28 times more than it spends on Amtrak. In fact, this

supplemental highway spending accounts for a larger share of our federal income

tax than Amtrak, Pell Grants, the EPA, Head Start, national parks and arts

funding combined, to name just a few things for which your support may brand

you a big-government liberal.

Next time I get into one of these debates, it would be

helpful to have Third Way's sample receipt in my pocket.

While rail-vs.-highway spending happens to be a pet issue of

mine, the most obvious things the above list highlights are the spending

behemoths at the top: Social Security, health care, the military and interest

on the national debt. If nothing else, an itemized receipt would say, "So you

want to talk about reducing government spending? Talk about these things

first." Which would be a far more focused public conversation than we're having

now.

Income-tax receipts aren't a new idea; people have been

proposing this sort of thing for years. If we can put a man on the moon and

then, 40 years later, persist in spending almost three times more on the space

program than we do on housing for poor people, we ought to be able to print a

receipt that says so.