The people's interest: A new battle against usury

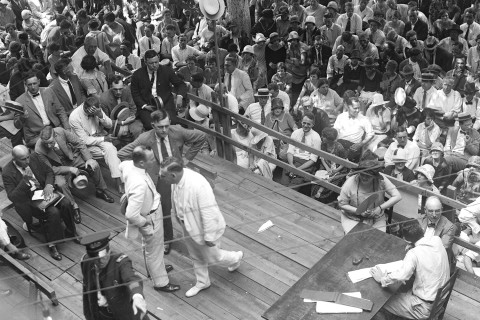

Walking down Trade Street in downtown Charlotte, North Carolina, Melinda Graham spied the Bank of America football stadium a few blocks away. “That’s all my money, right there,” said Graham, one of hundreds who marched on B of A and Wachovia one day last October to demand a 10 percent cap on credit-card interest rates.

A few minutes later, Graham noticed a pair of brown leather stilettos on a sharply dressed young woman. “Look at her shoes,” she urged her 21-year-old daughter. Then she looked at me, who had just asked her about her credit-card debt: “I’m a shoe fanatic,” she admitted.

Graham can no longer afford such luxuries. She started cutting her spending after her debt topped $8,000, which is about average for the nearly half of all Americans who carry a credit -card balance. She used to go to the cinema once a week or rent half a dozen movies to watch over the weekend, but not these days. “I can’t do the things I like doing, like getting away on the weekend,” she said. “I buy only the necessities.”

Still, it has taken her four years to pay off $3,000 of her debt; she has $5,000 more to go. After she lost her job at a cardboard factory last April, JPMorgan Chase raised her interest rate from 17 percent to 24 percent—an industry trend that prompted Congress to restrict rate increases last year (it takes effect in 2010). As she attends community college to become a physical therapy assistant, Graham pays $200 a month to Chase, $85 of which goes to interest.

“It’s hard to get that payment down when so much of it is going to [the bank],” she said. “You feel helpless because there’s nothing you can do. Well, until today,” she said, referring to the march. “Hopefully, this makes a difference.”

Graham came to Charlotte with members of her church, New Life Worship Center in Lexington, North Carolina, one of more than 500 congregations from the Midwest to the East Coast (along with some in Great Britain) who support limits on interest rates.

While conceding that careless spending is the chief cause of consumer debt and needs to be addressed, the march organizers object to the way credit companies make enticing offers of easy credit and then increase interest rates and impose profitable penalties.

The lead sponsor of the “10 Percent Is Enough” campaign is the Industrial Areas Foundation, a community-organizing network whose local chapters have worked for living-wage laws, affordable housing and school reform. Perhaps best known for training and employing Barack Obama in the 1980s, IAF’s history stretches back to the meatpacking labor movement of the 1930s and ’40s.

For many Christian leaders, who are the main recruiters for the interest-cap movement, concern for interest rates is rooted in biblical texts and traditional teachings of the church against usury—that is, against charging a fee for the use of money, otherwise known as interest. Medieval Christian thinkers attacked usury, but allowed moneylenders to profit in cases of shared risk, lost business opportunities or late repayment. The Reformers expanded the possibilities for charging interest, but urged that interest rates be kept at 5 percent or lower. The Reformers helped redefine the meaning of usury as “excessive interest.”

Usury laws in the U.S. kept most loans below 10 percent until 1978, when the Supreme Court allowed banks to incorporate in any state but do business in all states. Three decades later, average credit-card rates hover around 15 percent, and some go above 40 percent.

“It’s usurious if a credit card’s going to charge you 22 percent interest,” said David Jones, a Southern Baptist ethicist and author of Reforming the Morality of Usury, a 2004 book on Reformation-era debates. “If you’re profiting off of somebody else’s misfortune, then that’s always been viewed as wrong.”

The Torah is unequivocal in banning interest charges for fellow Jews in need. Exodus 22:25 states, “If you lend money to one of my people among you who is needy, do not be like a moneylender; charge him no interest.” Leviticus 25:35–37 likewise commends free loans as acts of mercy: “If one of your countrymen becomes poor and is unable to support himself among you, help him as you would an alien or a temporary resident, so he can continue to live among you. Do not take interest of any kind from him, but fear your God, so that your countryman may continue to live among you. You must not lend him money at interest or sell him food at a profit.” Psalm 15 describes a righteous man as one “who lends his money without usury.” Ezekiel 18 echoes the psalm, listing usury among such “detestable” sins as adultery, robbery and idolatry.

In Deuteronomy, charging interest is permissible only as an act of war. Chapter 23 protects all Hebrew borrowers, poor or not, but lifts the prohibition for outsiders: “Do not charge your brother interest, whether on money or food or anything else that may earn interest. You may charge a foreigner interest, but not a brother Israelite, so that the Lord your God may bless you in everything you put your hand to in the land you are entering to possess.”

The New Testament has plenty to say about sharing resources but surprisingly little to say about usury. Luke 6:34–35 is the text that comes closest to addressing it: “If you lend to those from whom you expect repayment, what credit is that to you? Even ‘sinners’ lend to ‘sinners,’ expecting to be repaid in full. But love your enemies, do good to them, and lend to them without expecting to get anything back.” Jesus here seems to erase the Deuteronomic distinction between Jew and gentile and to argue not only against charging interest but even against expecting repayment of principal. The early church father Tertullian saw the Hebrew ban on interest as foreshadowing an even more merciful gospel ethic of giving freely, rather than lending.

Living in an agrarian economy where trade was limited, the church fathers, like the Old Testament writers, considered the morality of moneylending primarily from the perspective of a needy person who borrows in order to survive—to secure food, clothing and shelter—not from the perspective of an entrepreneur. Ambrose, the most prolific patristic writer on usury, allowed for compensation in the case of a late repayment, but harshly condemned practices that oppressed the poor. “Is it not a wicked thing to demand under the guise of a kindly feeling a larger sum from him who has not the means to pay off a less amount?” he wrote. “Thou dost but free him from debt to another, to bring him under thy own hand.” Chrysostom preached that moneylenders sinned by driving debtors into poverty. Drawing on Jesus’ teaching on the “least of these” in Matthew 25, Augustine believed usury harmed Christ embodied in the poor.

Medieval church councils opposed lending at interest and called for excommunicating interest-charging clergy and unrepentant lay moneylenders. In the ninth century, the Holy Roman Empire outlawed usury, “where more is asked than is given.” Anselm, leaning on Augustine, labeled usury “theft”—a sin against justice, regardless of the borrower’s own financial status or the purpose of the loan. By 1159, canon law defined usury as “whatever is demanded beyond the principal.” Twenty years later, the Third Lateran Council called for excommunicating “manifest usurers” and denied Christian burial to moneylenders known to charge more than 40 percent annual interest. Up through Aquinas, theologians permitted interest only upon late repayment.

In the Reformation period, as the church grappled with the rise of trade, the morality of lending was the subject of fierce debate among both Catholics and Protestants. Hostiensis, a 13th-century cardinal, was the first church leader to approve of charging interest from the start of a loan (as with a modern car loan or home mortgage). Pope Leo X reversed the church’s ban on usury, allowing charitable pawnshops to undercut illicit profiteers by charging interest rates of around 6 percent to defray operating costs. Leo likewise allowed lenders to collect interest when land put up for collateral gained value. (But according to economic historian Eric Kerridge in Usury, Interest and the Reformation, Luther is said to have regarded this step as proof that Leo was “the Antichrist.”)

Calvin is sometimes called the father of capitalism because he approved of charging 5 percent interest on business loans. For Calvin, the fact that the gospel presents a universal ethic, erasing the difference between how one treats Jew and gentile, meant that interest could be charged to either. But Calvin was equally clear that “no one should take interest from the poor.”

Puritans brought usury laws with them to the New World. In 1713, the Statute of Anne had capped interest in England at 5 percent, and after 1791 all 13 colonies had usury limits at or below 8 percent. By the early 1900s, loan sharks were illegally charging as much as 500 percent on what we might now call “payday loans,” and states adopted annual rate caps of 24 to 42 percent as part of licensing these small, month-to-month loans.

In 1978, the U.S. Supreme Court ruled that banks could loan across state lines and apply the rate cap issued by their home states. That’s why we send our credit-card payments to places like Delaware and South Dakota. “This seemingly innocuous holding was like a gunshot starting a frenzied race-to-the-bottom in American usury law,” says University of Florida law professor Christopher Peterson. “Any bank can charge any interest rate it wants anywhere it wants.”

At an interfaith service in Durham the week before the Charlotte rally, Mikael Broadway of Shaw University Divinity School cited Deuteronomy 15 and compared ancient Hebrew and historic Christian economics to the practices of today’s bankers—like those who hiked Melinda Graham’s credit-card rate even as her own tax money was helping to stabilize their industry.

“We’re all very capable of making a mess of our lives,” Broadway said. “A few people can bungle it for the rest of us. This is not the kind of economic system intended for the world that God loves. God has a bailout plan for the Sabbath year and the Jubilee. It’s especially for making sure that people who fall on hard times don’t have to stay there forever.”

Broadway drafted a theological statement targeting banks in Charlotte, one of the nation’s leading financial centers. Twenty-five faculty members from nine seminaries in the Carolinas endorsed it, including faculty at Duke, Wake Forest, Campbell University, Gordon-Conwell in Charlotte and Hood Theological Seminary. Organizers delivered it to Bank of America, Wachovia (part of Wells Fargo), SunTrust and other financial institutions. Cam paigners in London lobbied such banks as Citigroup and the Royal Bank of Scotland.

As a result, IAF leaders obtained a meeting with executives at Bank of America and Wells Fargo. They made some progress with Wells Fargo on getting a 6-percent rate cap for military veterans and a reduction in foreclosures but were not able to move toward the 10-percent cap for consumers. Only Citigroup CEO Vikram Pandit has publicly endorsed a rate cap for general consumer credit—so long as it applies to every bank and exempts preexisting accounts. “Having high rates in this environment is not conducive to driving economic recovery,” Pandit told the Boston Globe.

The North Carolina IAF theological statement cites the Lord’s Prayer: “Forgive us our debts, as we forgive our debtors.” For the signatories, interest rates are matters of faith because “many banks (and hence, many business men and women of faith) currently are forcing people out on the street.”

A half-century ago, C. S. Lewis anticipated that interest rates posed an issue the church would have to face. “Some people say that when Moses and Aristotle and the Christians agreed in forbidding interest, they could not foresee the joint stock company, and were only thinking of the private moneylender, and that, therefore, we need not bother about what they said,” he wrote. “This is where we want the Christian economist.”

Baylor University professor Earl Grinols, president of the Associ ation of Christian Econ omists, looks at interest rates both as a finance expert and as a father who paid off thousands in credit-card debt for his adult daughter and son-in-law. The couple relocated a couple of times in search of employment and racked up some $10,000 in debt on four different cards. They decided to pay off the balance of one card, not knowing that this would make the banks think they were avoiding payments by transferring balances to new cards. The rate on their other balances nearly tripled, to 27 percent, even though they had always made their payments on time.

“They would have become virtual interest-rate slaves to the credit-card companies,” Grinols said. “We have in the credit-card industry today a lot of intentionally predatory behavior that any sensible person would not agree to.” Grinols objected so much to Bank of America practices that he boycotted L. L. Bean, one of his favorite retailers, until it dropped B of A as its logoed credit-card carrier.

Still, Grinols doesn’t favor strict usury limits. His beef with Bank of America was that it profited disproportionately from fees and penalties. Rather than reinstating usury laws, Grinols favors regulation like the Credit Card Accountability, Responsibility, and Disclosure (CARD) Act, signed into law by President Obama in May. This law requires a company to give 45 days notice before raising rates. More provisions are scheduled to take effect in February. The law will ban rate hikes on existing balances, encourage hard spending caps instead of over-limit fees, and mandate that payments go toward high-rate balances first, minimizing interest charges for the borrower.

Issuers responded to the law by raising rates before the deadline, prompting Congress to consider moving up the start date. In the first half of 2009, rates rose 20 percent on average, according to the Pew Charitable Trusts. Pew also found that nearly all card agreements allow companies to raise rates at any time. The national average is now around 15 percent.

A bill failed last spring that would have made 15 percent the maximum rather than the average. Senator Bernie Sanders (I., Vt.), the bill’s sponsor, found rates as high as 41 percent. But the issue is still alive. Representative Louise Slaughter (D., N.Y.) has introduced a bill to cap credit-card interest at 16 percent.

Like Grinols and most economists, Calvin College professor John Tiemstra thinks caps on interest rates would force lenders to deny credit to low-income borrowers who pose a higher default risk. Tiemstra applauds John Calvin for granting moral approval to interest lenders.

“There are just some times when it’s mighty handy to be able to borrow money, even if it’s at a really high interest rate,” Tiemstra said. “There are a lot of poor people held back by the fact that they can’t get credit.”

Tiemstra applauds John Calvin for approving loans with interest, though he doubts Calvin would approve of 30 percent interest rates. Tiemstra favors policies like consumption taxes that encourage people to save rather than spend. The real problem, from his perspective, is that Americans take too much risk with their money. Incomes haven’t kept up with the corporate success of the past 30 years, yet consumers want to enjoy the riches shown off by advertisers and wealthier neighbors.

“People say, ‘We have all this economic growth, and I’m going to take part in it someday,’” Tiemstra said. “‘Until I do, I’m just going to borrow and make it up.’”

Said David Jones, the Southern Baptist ethicist, “If you’re using it to buy a flat-screen television that you don’t really need, the problem isn’t really the credit-card interest rate, it’s your use of the credit.”

Believing that a rate cap would dry up the credit markets, Jesse Blocher, an economics Ph.D. student at UNC-Chapel Hill, took issue with members of his own church and the IAF affiliate in Durham over the “10 Percent Is Enough” campaign.

“A lot of new businesses are started by a couple of guys in their garage maxing out their credit cards,” he said. “We as the church would better spend our time trying to help people get out of debt rather than trying to take on Bank of America.” Agreeing on this point, the IAF in Durham added classes on budgeting to their antiusury organizing.

Liza Farmer, 80, a veteran of the civil rights movement who marched on Charlotte banks last fall, sees plenty of blame to go around. Credit card companies keep sending her offers, which she is wary of. Farmer herself has stayed out of debt, but her oldest son went bankrupt in his late fifties after a divorce led to a drinking problem that cost him his six-figure job. “He’d gotten used to living high off the hog,” she said. “He was making lots of money, and he was throwing it all away. He just bought whatever he wanted. There comes a rainy day, and he just wasn’t able to see it.”

So this elderly woman who had marched against segregation and poor labor conditions for factory workers joined debtors like Melinda Graham in singing protest songs outside Wachovia headquarters in Charlotte, complaining about easy, costly credit.

“I just see how it has caused us to want more and more.”